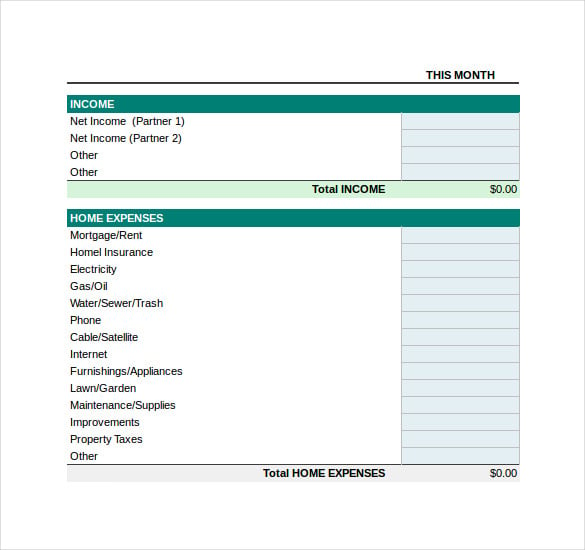

All formulas and graphs are programmed in.

It really helps to relieve the stress of only having one wage when you know exactly how much you can spend and if you can splurge when there is a sale on clothes! Read further on my tips for budgeting.Ĭouple the budget with the Bill Organiser and you are on the road to organised finances! I really recommend you find the time to sit with your partner, prepare your budget and work on a future plan together. When I first started comparing our budget to actual expenses I realised I spent a lot of money each month on magazines and hiring DVD’s, it was good to see, I didn’t stop myself from buying them, but instead I limited it. Every 6 months we sit down and work on our family budget to help ensure that we are not overspending and that we save money to put towards a big ticket item such as a holiday or new car. And the biggest lesson I learnt was to budget. My hubby Scott is an accountant (runs his own virtual accounting firm) he helped me to understand the changes that going to one income meant.

How much to anticipate our bills were each month.A few things that I needed to learn quickly was: The choice of becoming a stay at home mum and reducing the family income to one wage is a big adjustment.

0 kommentar(er)

0 kommentar(er)